Dream holiday, shattered calm: When the bank card disappears abroad

Dream holiday, shattered calm: When the bank card disappears abroad

A simple scene — a card disappears into the machine, panic on the beach. Why such incidents are more than a personal mishap and what banks, travellers and authorities could do better.

Dream holiday, shattered calm: When the bank card disappears abroad

How a swallowed card in Thailand becomes a major ordeal and what we should learn from Mallorca

The facts are brief: Iris Klein, long associated with Mallorca and mother of Daniela Katzenberger, is currently spending time in Thailand with her partner Stefan Braun. Shortly before their return journey she wanted to withdraw cash at an ATM, the card was taken in and panic followed. With the help of a friend the card was immediately blocked and her partner called the bank hotline. The bank explained the card had been captured for security reasons; the couple are now waiting for further information and a possible collection.

Key question: Why does a comparatively banal problem — an ATM retaining a bank card — cause so much stress for travellers, and which structural deficiencies does it reveal?

Critical analysis: At first glance this kind of incident looks routine: ATMs eat cards, security mechanisms kick in, customers are unsettled. But the real difficulty appears in the interaction of technology, communication and the travel context. People stuck abroad often have limited reception, different time zones and possibly language barriers. If a hotline is only reachable on national numbers or has long hold times, automatic card retention is of little use. Banks often refer to "security reasons"; that is understandable but unsatisfying for those affected, who do not know whether fraud is involved, how quickly a replacement will arrive and how they will cover ongoing expenses.

What is missing in the public discussion: there is a lot of talk about fraud schemes, less about everyday information gaps. Hardly anyone addresses how banks could communicate more transparently — for example standardised notices on ATMs in several languages, a clearly visible hotline for customers abroad, or automatic SMS/push notifications with concrete steps after a card is taken. The role of travel insurers, embassies and local bank branches also often remains unclear: who intervenes when, who pays for a replacement card and how quickly can that happen? Local incidents such as Beach robbery in Illetes: When a moment ruins a holiday underline how urgent clearer procedures can be.

Everyday information gaps can compound other travel problems, as in When the Finca Dream Collapses: Serious Questions Over a German Agent in Mallorca.

A Mallorca everyday scene to illustrate: Imagine the Plaça de Weyler on a mild January morning. A bakery cleans tables, tourists sip café con leche, a seagull cries over the Passeig. Someone at the ATM next to the phone booth notices the card is gone; they scroll through the app, tap nervously, ask the baker for advice. As small as the scene is, the consequences are large if contact with the home bank is not reliable. This mirrors other cases where personal items vanish abroad, such as From Ballermann to Isalnita: How a Stolen Phone Can Disappear 4,000 km Away.

Concrete solutions that banks, travellers and local authorities on Mallorca could implement:

For banks: 1) Clearer, multilingual notices on ATMs and when a card is captured, including phone numbers that are reachable from abroad free of charge; 2) greater availability of replacement cards via partner banks or express delivery with documented deadlines; 3) automatic digital messages to customers who spend extended periods abroad, including an emergency FAQ.

For travellers: 1) Carry two cards from different providers and store at least one separately; 2) check the terms for card blocking and replacement before travel and save phone numbers in an offline notes field; 3) keep a cash reserve for one to two days and store access data securely but accessibly; 4) take receipts or photos of the ATM and note the location — this helps with later complaints.

For local bodies such as tourist offices or expat groups on Mallorca: provide information sheets for travellers, offer workshops on "Safe payments abroad" or digital checklists that are also left in holiday apartments. Hotels and landlords could proactively point out risks at check-in and offer local support via a contact list.

Practical tip for emergencies: Block cards immediately via the app or the international hotline; check whether your bank can issue a second card by courier; if necessary, use mobile wallet payments or a trusted family member's transfer as a temporary solution.

Concise conclusion: A swallowed bank card is more than annoying bureaucracy. It is a small blackout in a traveller's everyday life that puts trust in systems to the test. Responsibility does not lie solely with customers: banks must provide practical cross-border emergency routes. Travellers should not rely on a single payment method. And in Mallorca, between Passeig and promenade, we can tackle the problem locally by offering more information and pragmatic help for everyone who leaves from here — or is just returning.

Read, researched, and newly interpreted for you: Source

Similar News

Estellencs and Water: Why a Desalination Plant Must Be Just the Beginning

The municipality of Estellencs plans to build a small desalination plant — funded by the Balearic government. A necessar...

Despite Renovation: Why Palma’s Paseo Marítimo Remains Empty — A Reality Check

After COVID and long construction works, venues on the Paseo Marítimo are struggling with dwindling customers, rising re...

Five Municipalities Lose Residents – Who Gets Left Behind?

Sant Llorenç des Cardassar, Escorca, Estellencs, Mancor de la Vall and Banyalbufar recorded declines. Why are small muni...

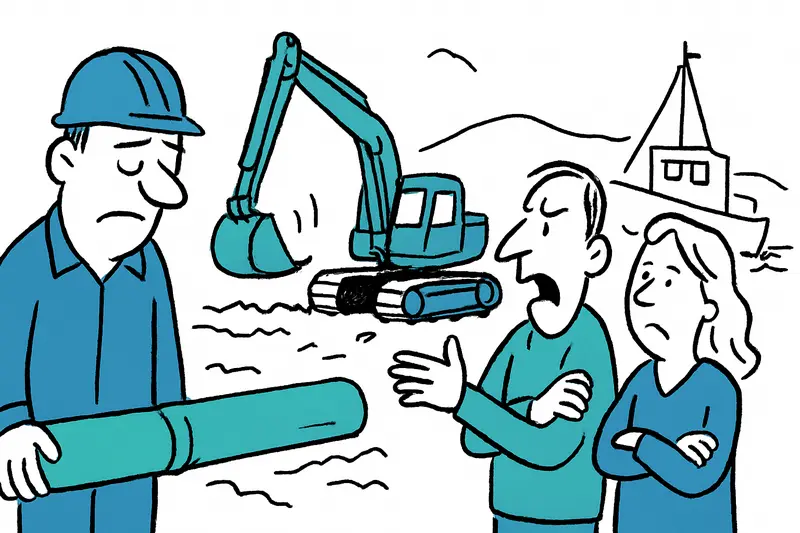

Major construction in Port d'Andratx: Who pays the price for the sewer renewal?

In the harbour of Port d'Andratx work is underway to modernize the sewage system – more than €4.1 million, heavy machine...

Cardiac Arrest on Bike Tour: What the Death near s’Aranjassa Means for Mallorca’s Cycle Routes

A 72-year-old cyclist suffered a cardiac arrest near the airport and died at the scene. The incident raises questions ab...

More to explore

Discover more interesting content

Experience Mallorca's Best Beaches and Coves with SUP and Snorkeling

Spanish Cooking Workshop in Mallorca